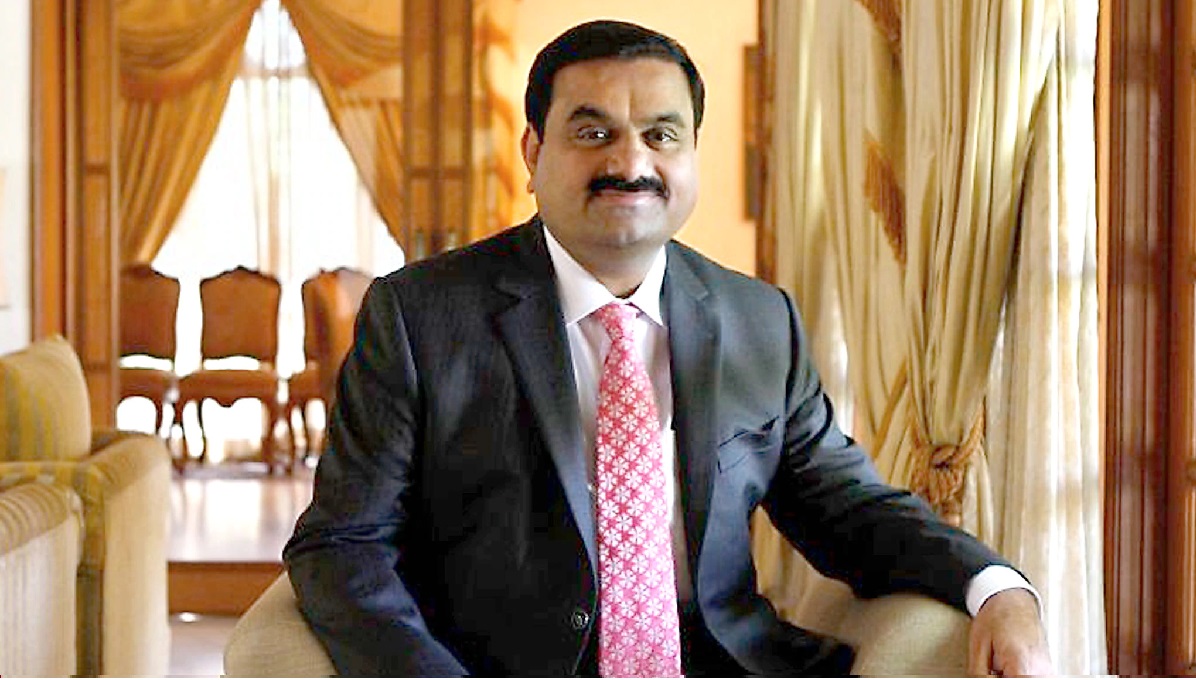

New Delhi. The Adani Group, run by the country’s richest businessman Gautam Adani, on Wednesday rejected the claims of American short seller Hindenburg Research. Also said that the purpose behind the allegations of the American company is to harm Adani Group’s upcoming Follow on Public Offering (FPO). Let us tell you that the shares of Adani Group, led by Indian billionaire Gautam Adani, saw a round of selling on Wednesday. There was a sharp decline in the stock market. While the Sensex plunged by over 700 points, the Nifty plunged by over 200 points. The reason was Hindenburg’s 88-question report.

As soon as the report was released, there was a tremendous decline in the stock market. Shares of many companies of Adani Group fell by almost 5%. The well-known American company alleged in the report that the Adani group was involved in stock manipulation and accounting fraud. Hindenburg told that this has come to the fore after two years of investigation report. Strongly denying the report, Adani Group has termed it as malicious, baseless and one-sided. Also, the company said that the intention behind this report is to harm the upcoming FPO of the company. Let us tell you that only one week is left for the FPO of Adani Enterprises to come.

Hindenburg also disclosed in the 88-question report that she held short positions in Adani Group shares, which meant she would exit the company’s shares in the short term. The American firm also said that the valuation of Adani group companies is much higher than the market and the shareholders of the company will have to bear the brunt of this.

Describing it as a head-less report, Adani Group said that Adani Group has always set a standard by following the highest scale of business and its living proof is the company’s thousands, lakhs of investors who have invested their capital in the company. This has been proved by applying.