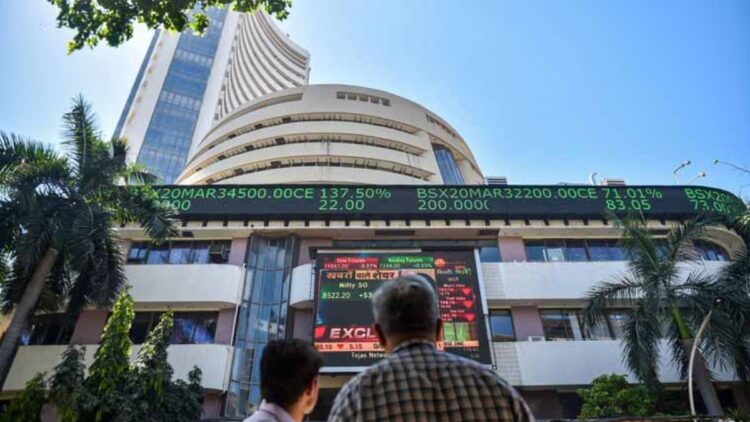

Stock market

The stock market flat closed on the budget day. That too when the income of up to Rs 12 lakh in the budget was made tax free. After all, what did the market not like? The market did not like capital expenditure. That is, there was no big announcement to increase government spending, which the market was expecting. A new week is starting from today. What can be expected between all these news? Will the market return or be recession? Which are those sectors, which will get the most benefit of budget announcements? Let’s know.

Market focus will shift

Market expert says that the market focus will be shifted after the budget. FMCG, auto, tourism and agricultural-related shares were seen to be a sharp jump on the budget day. Measures supported by rural income and middle class consumption led to a boom in these sector companies. In contrast, areas such as capital goods, defense, oil and railways have seen a major decline after the budget. Now the focus of the market will move towards the insurance sector, tourism sector, FMCG, Aviation, Energy and Leather Sector. Good companies of these sectors can see a good rise.

Keep an eye on the stock of these companies today

Power Grid Corporation of India, Divis Laboratories, Alembic Pharmaceuticals, Aditya Birla Capital, Barbecue-Nation Hospitality, Bombay Diing, Castrol India, Domes Industries, Draering Corporation of India, Gatewords, Gatewells of India, Gland Pharma, Garden Reach Shipbuilders and Engineers, HFCL, Jyoti Structures, KEC International, KPR Mill, NLC India, Paradip phosphates, poly Medicure, Premier Energy, Shelby, Shankara Building Products, Stove Craft, Tata Chemicals, Vishnu Prakash Ri Pangalia and Welpan Hutchchal may be seen in the stock of enterprises.

Latest business news