Investment in gold

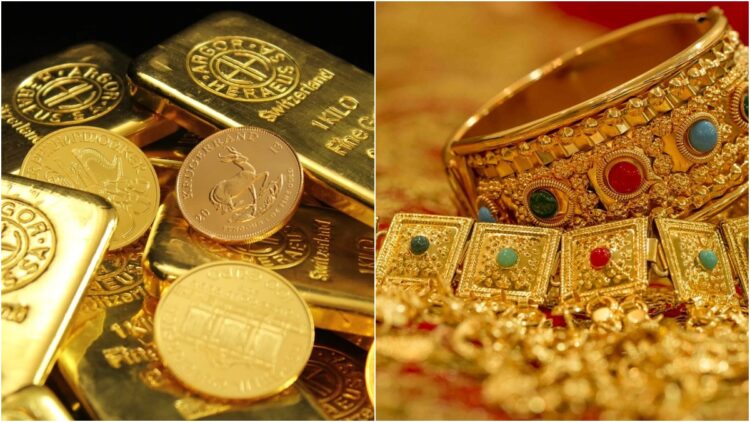

There is a tremendous rise in the price of gold. The price of 10 grams of gold in the domestic market has gone beyond Rs 92,000. The price of gold will continue to increase further. In such a situation, buying physical gold i.e. gold coins, rods or jewelery will be beneficial for investment or Gold ETF will be a better option. If you are an investor, then we will compare you between these two investment mediums and tell you where to invest for the next 10 to 20 years will be more beneficial. Let’s know.

Digital gold

Options such as Gold ETF (exchange-traded funds), Sovereign Gold Bonds (SGBS), and Digital Gold are available in the market. These are right for those who want to invest without physical gold. These options prevent the hassle of buying, selling and keeping it safe.

Physical gold

The satisfaction of holding and watching physical gold like gold coins, jewelery and rod in hand is not found in digital gold. Apart from this, people consider to be auspicious to buy physical gold on weddings and festivals such as Akshaya Tritiya, Dhanteras, Diwali. People not only like to wear gold jewelery in India, but also consider it a safe investment, which can be sold when needed. This is the reason that gold is purchased every year according to tons in the Indian market, and people never reduce interest in it.

What is Gold ETF?

Gold ETF (exchange-traded funds) are traded on stock exchange. Its price is related to physical gold. This is an excellent option for those who want to invest in gold, but avoid anxiety of storage, theft or inaccuracy. However, it is necessary to have a demat account to invest in Gold ETF.

Physical Gold and Gold ETF: Who Better Investment Options?

If you look at the price of gold in the last 10 years, the price of gold in 2015 was ₹ 26,340 per 10 grams. At the same time, now the price of gold in 2025 has reached ₹ 92 thousand per 10 grams. In this way, gold has given a return of 12% annually. Now if you look at Gold ETF, then in the last 10 years: 11.44% (average CAGR) has given returns. That is, physical gold (12%) and gold ETF (11.44%) have been almost the same in 10 years of returns. In such a situation, if there is no tension to keep gold safe, then physical gold is not a bad option from anywhere. You can buy either of the two as per your convenience.

Latest business news