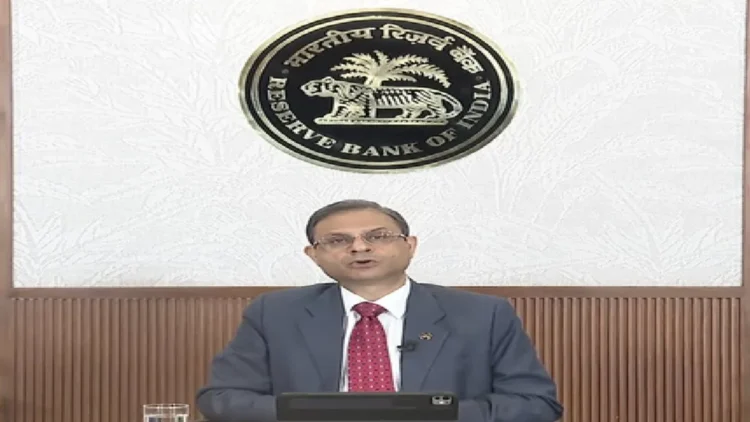

Mumbai If you have taken a car or house loan, then on 6 June you can get the good news of its EMI being reduced. From today, the Monetary Committee of Reserve Bank of India i.e. MPC is being held. On June 6, RBI Governor Sanjay Malhotra will explain what was decided on interest rates in the MPC meeting. Inflation is currently under control. Because of this, RBI can cut the repo rate further. If the repo rate is reduced, the EMI of your loan will also definitely be low. Earlier, in the last MPC meeting, the RBI had reduced the repo rate by 25 basis points.

A report of State Bank i.e. SBI has come before the commencement of MPC meeting. SBI has hoped that the repo rate can be reduced to 50 basis points in the RBI MPC meeting. If this happens, the EMI of the loan will be reduced considerably as your big relief. However, RBI will have to consider a lot about making such a big cut in the repo rate. Because the fall in repo rate reaches a lot of money in the hands of people and there is a possibility of bounce in inflation. It is expected that RBI’s MPC may cut the repo rate by 25 basis points.

Currently the repo rate is 6 percent. Prior to the MPC meeting in April, the repo rate was 6.50 percent. In fact, since 2022, the continuous inflation figure was going above 5 percent. In such a situation, at that time the RBI continued to increase the repo rate. This move of RBI led to the level of inflation below 5 per cent. The repo rate is the rate of interest on which the RBI gives loans to other banks. Increased repo rate reduces liquidity with banks. Due to which less money comes in the hands of the common man. This causes inflation to decrease. However, due to decrease in repo rate, those who invest money in FD or other deposit schemes are shocked. Because the interest rate of these schemes also decreases.