Gold quin

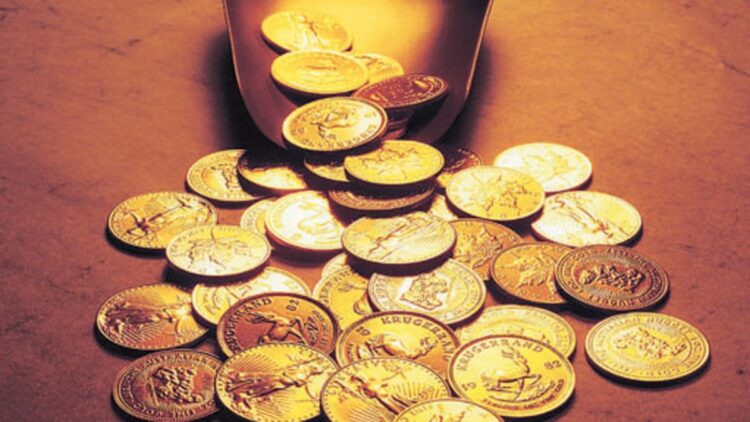

The price of gold has once again reached close to Rs 1 lakh per 10 grams. However, there is a different kind of craze among Indians towards gold. No matter how much the price increases, we will buy gold. Let us tell you that in the last one year the price of gold has increased by 40% and 70% in 24 months. Despite this, people are buying gold. Sona is also called a companion of crisis. In such a situation, if you are planning to buy gold too, then buy a gold coin instead of jewelery. Gold coins come in different weight. You can buy gold coins with different purity of 22 or 24 carats from 0.5 grams to 100 grams, and 22 or 24 carats. Also, it is easy to convert it into cash. You just have to sell to meet your cash needs. Let’s know what are the benefits of buying gold coin?

Benefits of buying gold coin

Guarantee of purity: Gold Quine comes in 22 or 24 carats. There is no worry of purity due to the hall mark. Get rid of making charge: Making charge or design cost on gold coin is very rare than jewelery. Generally, Sonar charges 10 to 15 percent of the making charge on jewelery. Easy to sell: Gold Quin can be easily sold or pledged through jewelers, banks or gold loan companies. Investment in less money: Gold quine is available from 0.5 grams to 100 grams, so that you can invest in less money as per your convenience. Better returns: The price of gold increases over time, making Gold Quin a safe and stable investment option. Low risk: Gold Quin is considered a reliable investment option in the era of inflation and economic uncertainty.

In this way, if you buy gold coin instead of gold jewelery, then you will always be more benefiting. If needed, it will be easy to compete with money jewelery.

Latest business news