New Delhi, 9 April (IANS). Union Finance Minister Nirmala Sitharaman has insisted that India provides an attractive opportunity of development for foreign banks and the government is actively encouraging foreign investment in the banking sector.

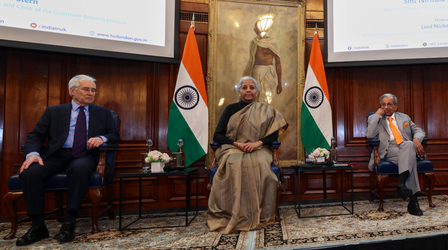

The Union Finance Minister addressed the India-UK Investor Roundteable discussion with about 60 investors representing various pension funds in London, insurance companies, banks and other financial institutions.

In this address, the Union Minister underlined the priorities of the government to enable sustainable economic development and investment opportunities with policy support.

According to a statement issued by the Finance Ministry on Wednesday, he highlighted the efforts being made by the government to reduce compliance burden and make the regulation easier for the convenience of the convenience of business and investment.

With middle class expansion and strong and stable policy environment, the Union Finance Minister said that India is set to become the sixth largest insurance market by 2032, with an expected increase of 7.1 percent CAGR by 2024-2028, which will be one of the fastest growing insurance markets in G20 countries.

Finance Minister Sitharaman told investors that the Indian Securities Market is one of the first major markets to fully adopt “T+1 Settlement” in the beginning of 2023 and India’s market capitalization is $ 4.6 trillion (3.7 trillion GBP), which is currently at the global level fourth.

The Union Finance Minister spoke in detail about India’s first International Financial Services Center GIFT-IFSC.

He further informed the investors that by March 2025, more than 800 institutions in banks, capital markets, insurance, fintech, aircraft leasing, ships leasing, bullion exchange, etc. have been registered with the International Financial Service Center Authority (IFSCA).

The Finance Minister, describing India’s digital economy as a significant contributor in its economic development, informed the participants that India ranks third in terms of domestic unicorn.

He further stated that India is home to the leading Fintech Ecosystem, operated by a large technology-lover population, assistant government policies and innovative startup ecosystem.

In the last 5 years, the region has seen a rapid jump in Fintech, as is clear from an 87 percent adoption rate and 15 percent of the global fintech funding as against the global average of 64 percent.

The Union Finance Minister also participated in a firecusside chat on India House in London ‘opportunities and challenges for India’s efforts to become a developed economy by 2047’.

-IANS

SKT/CBT