Mumbai, 22 February (IANS). India’s Pension Assets Under Management (AUM) is estimated to increase to Rs 118 lakh crore by 2030 and the National Pension System (NPS) stake in it may be close to 25 percent. This information was given in a report.

The NPS private sector AUM has recorded a strong annual growth and has increased by 227 percent to Rs 2,78,102 crore in the last five years, which was earlier Rs 84,814 crore.

The report of DSP Pension Fund Managers states that India’s elderly population is estimated to be 2.5 times by 2050. Also, after retirement, life expectancy rate will increase by an average of 20 years.

Currently, India’s pension market is quite small and only 3 percent of GDP.

The retirement savings difference is expected to increase by 10 percent annually, which will potentially reach about 96 trillion dollars by 2050.

The report said that Indian retail investors are rapidly moving from the ways of traditional savings to the market related investment. In the last decade, the dependence on cash and bank deposits has fallen from 62 percent to 44 percent, which shows this change.

There has been a strong growth in new NPS registration between FY 2020 and 2024, with 65 percent increase in male customers and 119 percent in female customers.

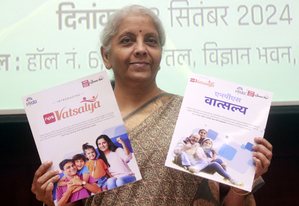

The NPS Vatsalya introduced by the government in September 2024 has received a good response, which has attracted more than 86,000 customers.

The report further stated that the NPS private sector AUM with more than 1.5 crore customers is estimated to be more than Rs 9,12,000 crore within the next five years.

Rahul Bhagat, CEO, DSP Pension Fund Managers, said, “We believe that India’s pension market is on the way to grow rapidly and with the right policies and increasing awareness, it has the ability to unlock the significant value for its citizens with the right policies and increasing awareness. . “

-IANS

ABS /