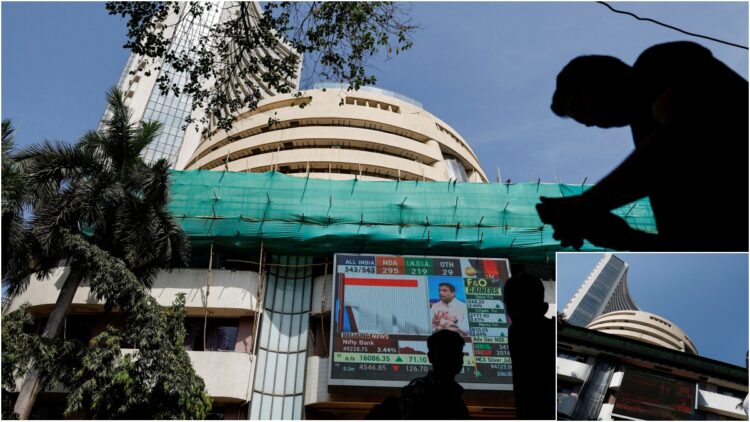

Sensex

The recent decline in the Indian stock market after the September 2024 high level is attracting investors to invest in the country’s long -term growth story. Legendary brokerage firm Morgan Stanley said this. The firm has revised its base case Sensex Target for June 2026. Also, the firm estimates that if the market rises, the Sensex will reach 1,00,000 points. In his new report, Morgan Stanley has set the base case target of 89,000 of the Sensex by June 2026, which reflects the growth of 8% from the current levels. However, brokerage in the bull case scenario estimates that the Sensex may touch the target of 1 lakh in the beginning of June 2026.

This level suggests that the BSE Sensex will trade 23.5X trailing P/E on multiple, which is ahead of the 25-year average of 21x. Morgan Stanley reports that the premium on historical average reflects the medium -term development cycle in India, the lower beta of India, high terminal growth rate and more confidence in an estimated policy environment.

Base case landscape

In the base case scenario, brokerage is estimated to reach 89,000 of the Sensex by June 2026. Its possibility is 50 percent. It estimates fiscal consolidation, increasing private sector investment and positive Real Development-Real Interest Rate’s continuous improvement in India’s comprehensive economic stability. A stable domestic development approach, the absence of the US recession and the stable prices of oil are also included in the forecast. The base case also includes progress on a favorable Indo-US trade agreement, a reduction of 0.50 per cent in short-term interest rates and a overall positive liquidity environment. Under this scenario, the Sensex income is expected to grow from CAGR of 16.8% by FY28.

Bull case landscape

In the bull case, Morgan Stanley imagines a more favorable, broad and policy environment, leading to the Sensex to reach 1,00,000 by June 2026. Its possibility is 30 percent. The main assumptions include the crude oil prices to be below $ 65 per barrel continuously, making more monetary relaxation by the RBI and solving global trade stresses through the inverter in tariff policies. In addition, unpredictable policy reforms – such as GST rate cuts and progress on agricultural reforms – can also accelerate further. Income increase in this scenario is estimated to increase by 19% annually by FY25-28.

Beer case landscape

Morgan Stanley gives 20% probability to her bear case, with the Sensex falling to 70,000 by June 2026. This landscape estimates a sharp increase in crude oil prices above $ 100 per barrel, making monetary strictness by RBI to maintain comprehensive economic stability. It also includes important recession in global development, including recession in the US. Income increase in these conditions is expected to be reduced by 15% annually by FY28, with a remarkable recession in FY26.

Latest business news