Mumbai, 7 April (IANS). On the major decline in the Indian stock market, experts have said on Monday that investors will have to keep an eye on the action of the European Union (EU) and other countries in response to the US reciprocal tariff.

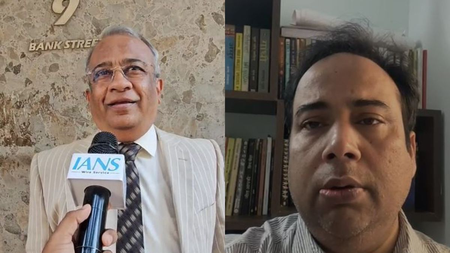

Speaking to news agency IANS, market expert Sunil Shah said that nearly 4 percent decline in the stock market today is due to 34 percent tariff from China in response to the US reciperook tariff.

Shah further said, “All investors know that no country is going to benefit from tariffs and due to this the world markets are seeing a decline.”

He further stated that further action in the stock market will depend on the action of European Union (EU) and other countries.

Economist, Pankaj Jaiswal told IANS that the world is in reset mode for the first time after World War II, which has led to a huge decline in the world’s stock markets including India. Due to trade war, there is a threat of recession and inflation in the world and it will have the most impact on America.

The Indian stock market is in red mark by trade war. The Sensex was down 2,849 points or 3.78 percent to 72,515 and the Nifty was 910 points or 3.97 percent to 21,991.

Selling was seen in most Asian markets. Tokyo, Shanghai, Bangkok, Seoul and Hong Kong have recorded a decline of up to 11 percent.

Due to the reciperook tariff, heavy selling was seen in the US markets on Friday. Dow 5.50 percent and Technology Index Nasdaq closed down by about 5.82 percent.

There has been a sharp fall in oil prices amidst global uncertainties. Brent crude fell by 2.67 percent to $ 63.82 per barrel, while West Texas Intermediate (WTI) crude falls 2.69 percent to $ 60.31 per barrel.

-IANS

ABS/