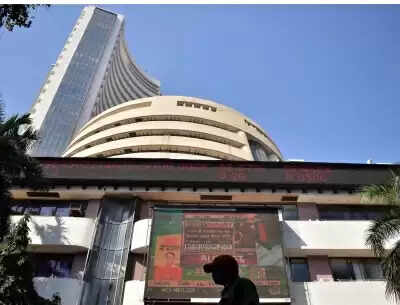

Mumbai, May 12 (IANS). Due to the consent on the ceasefire between India and Pakistan, there was a wave of happiness among investors and it directly affected the Indian stock market. In the same day, the assets of investors increased by more than Rs 16 lakh crore.

The Sensex and Nifty saw the highest 4 per cent rose since February 2021.

Positive global and domestic signals strengthened the market sentiment and the Indian stock markets achieved great success in registering ‘Best Single Day Performance’ in the last four years.

At the end of the trading, the Sensex closed at 82,429.90 level with a great rise of 2,975.43 points or 3.74 percent. At the same time, the Nifty rose by 916.70 points or 3.82 percent to close at 24,924.70.

This was the second largest ‘percentage profit’ for both indices in the last four years, before the only major rise was recorded on February 1, 2021, when the index climbed more than 4.7 percent.

Many factors played an important role in the market boom. Factors were important for the market such as a ceasefire between India and Pakistan, a positive trend in the US-China trade talks and the report of peace talks between Russia-Ukraine.

These developments helped reduce geopolitical stress, improving global risk ability and increasing the confidence of investors.

All the sectoral index closed in the green mark, showing widespread improvements in all areas.

US President Donald Trump had commented on a reduction of up to 80 percent of the drug prices, after which the Nifty Pharma index opened with a decline of 2 percent. At the end of the trading, the index closed up 0.15 percent.

The Nifty IT and Nifty reality index were the highest rise, which rose up to 6 percent and 7 percent respectively.

Midcap and smallcap stock also joined the boom, which better than a wider market with an increase of 4.1 percent.

The total market capitalization of all the companies listed in BSE increased from Rs 416.52 lakh crore to Rs 432.47 lakh crore in the previous session (May 9), with which an increase of Rs 16 lakh crore was recorded in a single day.

According to analysts, the market started the week with firmly due to favorable global and domestic signals.

Ajit Mishra, Senior Vice President (Research), Railways Broking Limited, said, “All major areas contributed to the rapid, with IT, reality and metal at the forefront. The broad markets also showed this strength, each of which recorded a growth of about 4 percent.

Reduction in geopolitical concerns and progress in global trade talks gave considerable relief to the markets, which showed the impact as a sharp decline in the India VIX instability index.

He said that technically, a sharp increase in Nifty indicates to continue the rapid trend after a three -week consolidation phase.

After crossing the previous swing high of 24,857, the index is now moving towards a level of 25,200, while there is expected to get strong support on any fall between 24,400 and 24,600.

-IANS

SKT/ABM