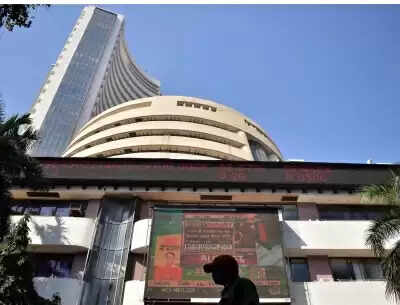

Mumbai, July 11 (IANS). Uncertainty about the tariff imposed by US President Donald Trump, the Indian stock market opened in a red mark in Friday trading session.

At 9:38 am, the Sensex fell 216 points or 0.26 percent to 82,973 and the Nifty was 51 points or 0.19 percent to 25,310.

In early trade, selling is also being seen in midcap and smallcap with largecap. The Nifty Midcap 100 index declined by 78 points or 0.13 percent to 59,081 and the Nifty Smallcap 100 index was 27 points or 0.15 percent with a weakness at 18,928.

The Sensex pack featured HUL, Asian Paints, Axis Bank, NTPC, Power Grid, Tata Steel, SBI, Adani Ports, Tata Steel, Sun Pharma and ITC top gainers. TCS, Infosys, M&M, Tech Mahindra, HCL Tech, Bharti Airtel, Bajaj Finserv and Trent were among the top losis.

On sectoral basis, PSU Bank, Financial Services, Pharma, FMCG and metal were in green mark. Auto, IT, realty and media were in red mark.

Choice Broking’s Mandar Bhojne said, “Given the current environment filled with uncertainty and extreme volatility, traders are advised to adopt a vigilant” Weight and Watch “approach in especially in terms of leveraged positions.”

He further said, “Earning partial profits in such a market and installing strict trailing stop-loss will be a better strategy.”

Stock markets in Asia had mixed trading. There was a flat business in Nikkei 225 of Japan and Kospy in South Korea. However, China’s Shanghai Composite and Hong Kong’s Hong Seng had a gain of more than one percent.

Trump announced a 35 percent tariff on Canada and warned Ottawa to impose more tariffs for retaliation. These tariffs will be effective from August 1.

In the last trading session, Wall Street’s major index in the US, S&P 500 and Technology Index Nasdac Composite recorded a record lead. Dow Jones climbed 0.43 percent and S&P 500 saw an increase of 0.27 percent.

Foreign institutional investors (FIIs) bought shares worth Rs 221 crore on July 10, while domestic institutional investors (DIIs) also bought shares worth Rs 591 crore on the same day.

-IANS

ABS/