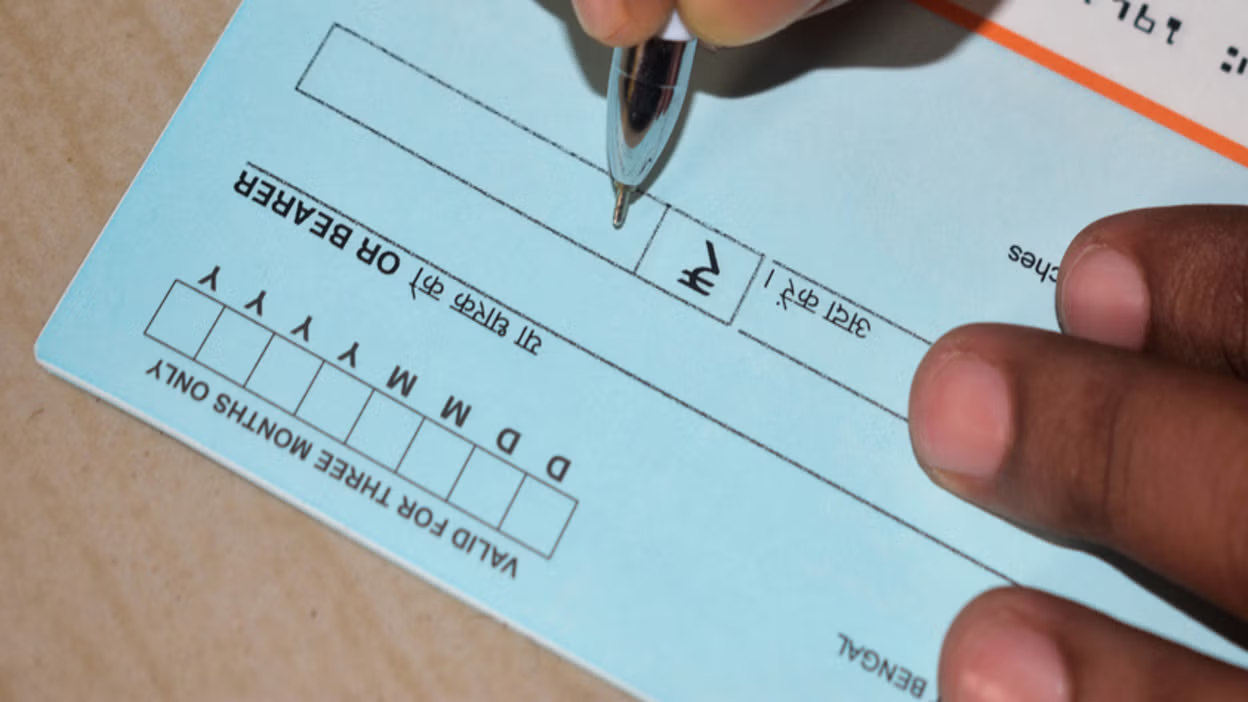

We all have heard of the check. Those who work in banks are very familiar with the check and they also know that nowadays there are online mode and UPI for money transactions, but the practice of withdrawing money from the check has been going on for years. However, one thing that people know a little less is that if the check bounces, that is, people have to pay a fine and it can also affect civil history. There is also a provision of punishment in more serious cases. Here you know how much penalty can be imposed if the check bounces.

When someone gives a check to the bank for payment and the check is rejected due to lack of money in the account or any other reason, it is called a bounce check. There can be many reasons for this but the main reason is not to have enough money in the account. Explain that the check bounces even if there is a difference in sign on the check. On the check bounce, the amount is deducted from the account as a fine. When the check bounces, you have to inform the debtman and the person will have to pay within a month. If payment is not made within a month, then a legal notice can be sent to him. Even after this, if he does not give any answer for 15 days, a case can be registered against him under Section 138 of the Nign Instrument Act 1881.

Check bounce is a punishable offense and a case can be registered under Section 138. It has a fine or two -year imprisonment or provision of both. When the check bounces, the debtor has to pay the amount with 2 years penalty and interest. The case will be registered at your place of residence. 350 rupees per check by customer (a check is returned in a month), if the check is returned twice in a single month for financial reasons, then Rs 750 in that case. If there is any other reason other than the signature verification and the check returns due to financial reasons, then a fee of Rs 50 will be charged in that case.