People often ask what is the difference between PAN, TAN and TIN card numbers. It is often seen that these words used in the behavior field appear to be the same. However, their meanings are different. If you do not know the meaning of PAN, TAN and TIN card. In such a situation, this news is special for you. Today we are going to tell you about this. In this episode, let us know what is the difference between PAN, TAN and TIN card numbers?

What is a tan number?

TAN means (tax deduction and collection account number). This is a special type of ten -digit alphanumeric number. It is issued by the Income Tax Department. It is used to track TCS and TDS. You should know that TCS means tax collected at the source. While TDS means tax deduction at source. TAN must be used. If you do not use it, the bank may reject your TDS payment. You can use Form 49B to apply online and offline.

What is tin number?

TIN means tax number. It has an 11 -digit alphanumeric number. In this, the first two digits show the state. This order has been given by the Ministry of Home Affairs. TIN is a special type of identification number. It is used in interstate sales transactions.

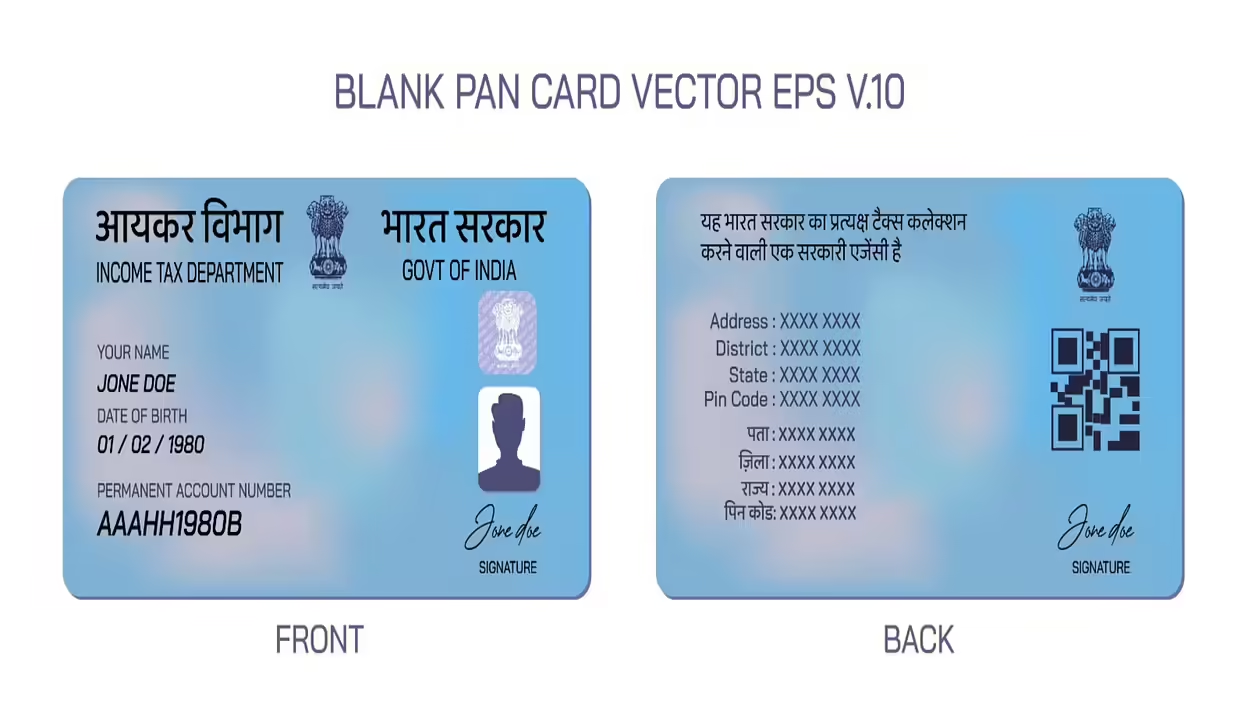

What is PAN number?

PAN means (permanent account number). It contains ten digital alphanumeric numbers. The PAN number is issued by the Income Tax Department. With the help of this number, the government monitors the transactions made by the card holder.