Congress on Wednesday said drastic action is needed to clear the cloud of slowdown in growth and investment in the country due to reduction in GDP growth estimate for the current financial year.

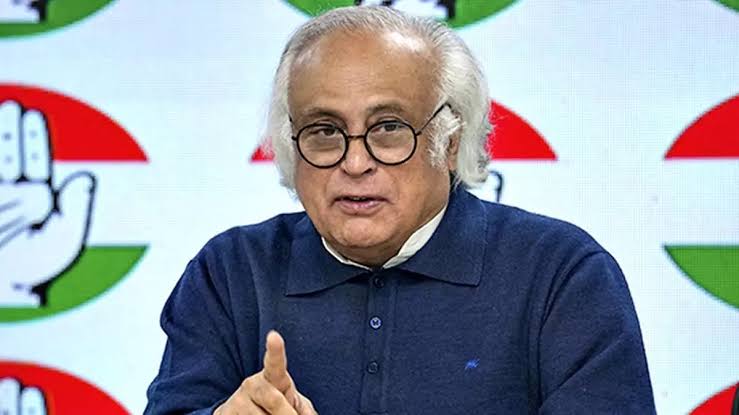

Jairam Ramesh, general secretary and communication in-charge of All India Congress Committee, said that this has created a disappointing background for the Union Budget as well.

He suggested that income support for India’s poor, higher MNREGA wages and an increase in the minimum support price (MSP) were the need of the hour, and he called for massively simplifying the “ridiculously complex” GST regime and making it easier for the middle class. Demanded relief in income tax.

Ramesh said in a statement that the advance estimates released by the Central Government for GDP growth in the financial year 2024-25 have estimated a growth of only 6.4 percent.

“This is a four-year low and a sharp decline compared to the 8.2 per cent growth recorded in fiscal year 2024 (2023-24). This is also lower than the RBI’s recent growth forecast of 6.6 per cent, which is That’s down from the earlier estimate of 7.2 percent. In just a few weeks, the base of the Indian economy has fallen, and the all-important manufacturing sector has refused to expand as it should.”

The Congress leader said the government can no longer deny the reality of India’s growth slowdown and its various dimensions. He alleged that India’s consumption story has reversed in the last 10 years and it has emerged as the biggest problem for the economy.

He said, “According to the data of the second quarter of this year, the growth rate of private final consumption expenditure (PFCE) has declined to 6 percent from 7.4 percent in the previous quarter. Car sales have reached a four-year low. Many CEOs in Indian business have themselves expressed concern over the ‘shrinking’ middle class, which is not only directly impacting the GDP growth rate, but is also the reason why the private sector is reluctant to invest in capacity addition. Is.”

Ramesh also pointed to the slowdown in private investment, saying the government estimates growth in gross fixed capital formation (public and private) to slow to 6.4 per cent this year, compared to 9 per cent last year.

He said even this figure hides the true extent of the private sector’s reluctance to invest in India.

The Congress leader said, “As acknowledged by the government’s own Economic Survey (2024), private sector GFCF (gross fixed capital formation) in machinery and equipment and intellectual property products is expected to grow by FY23 (2022-23). There has been only 35 per cent growth cumulatively in four years… This is not a healthy mix. It has got worse since then, with new project announcements by the private sector in FY23 and FY20. 24 (2023-24). The reluctance of the private sector to invest in adding new productive capacity means that our medium-term growth will continue to suffer.”

Ramesh said big promises were made about increasing capital investment in the Union Budget 2024-25, in which Rs 11.11 lakh crore was allocated. Ramesh said only Rs 5.13 lakh crore had been spent till November and claimed this was 12 per cent less than last year.

He claimed, “Most projections suggest the government will fail to meet the target before the end of the fiscal year. The government’s own inability to spend its money is partly responsible for the widespread economic gloom.”

Pointing to the “decline in household savings”, he said the central government’s own data shows that the net financial savings of households have declined by Rs 9 lakh crore between 2020-2021 and 2022-2023.

Meanwhile, he said household financial liabilities stood at 6.4 percent of GDP – the highest in decades. “The grave policy failures of the COVID-19 pandemic continue to haunt India’s families.”

Ramesh said, “This is a disappointing backdrop to the upcoming Union Budget for the financial year 2025-26 (2025-26). As the Indian National Congress has consistently advocated, the fundamental need to overcome these clouds of growth slowdown and investment action required.”

He suggested that, “Income support for India’s poor, higher MNREGA wages and increased MSP are the need of the hour, along with comprehensive simplification of the ridiculously complex GST regime and income tax relief for the middle class.” “

The government will present the Union Budget on 1 February.