Business News Desk – During the Union Budget 2024-25, Finance Minister Nirmala Sitharaman discussed several schemes, out of which one special scheme was to open pension accounts for minor children. To keep the children financially secure in the future, the NPS Vatsalya Yojana was announced by the government of the country, which will be launched by Finance Minister Nirmala Sitharaman on 18 September 2024. Under this scheme, parents will be able to make their child’s future financially strong, let us know in detail what is the new NPS Vatsalya Yojana of the government?

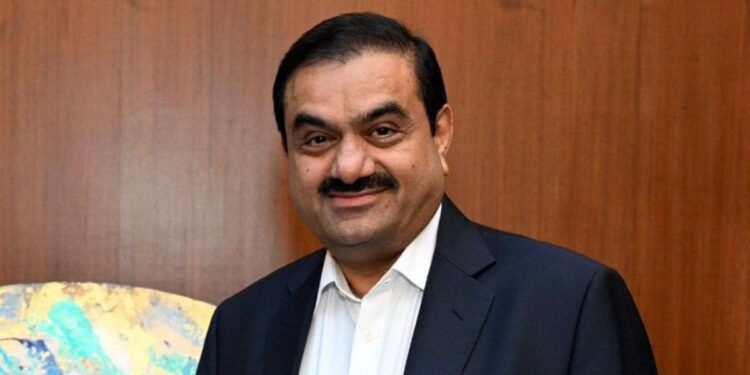

Nirmala Sitharaman to launch NPS Vatsalya

Finance Minister Nirmala Sitharaman will launch the NPS Vatsalya scheme as well as an online platform on 18 September 2024. Information related to the NPS Vatsalya scheme will be released. Also, a Permanent Retirement Account Number (PRAN) card will be issued as a subscriber card for new minor children joining the scheme. Permanent Retirement Account Number will be allotted to minor subscribers by the Finance Minister.

What is NPS Vatsalya Plan?

Parents who want to financially secure the future of their children can join the NPS Vatsalya Yojana, which is a kind of pension account. In such a situation, it can be said that pension accounts of minors will be opened under this scheme. Under this scheme, parents can invest with a long term. Flexible contribution option will be available under the scheme.

Who can invest in NPS Vatsalya Plan?

All parents can invest under the NPS Vatsalya scheme. There is no difference of lower or upper class in this scheme. Parents can open a pension account in the name of the child, for which Rs 1000 has to be deposited annually in the account. This scheme will be available with flexible contribution and investment options. When the child grows up, that is, when he becomes an adult, this scheme will be linked to the NPS account, which is currently known as a retirement plan.

What is an NPS account?

The full name of NPS is National Pension System. This account is opened as a retirement plan. Under this, the account holder gets regular income or pension after retirement. National Pension Scheme is also called Contributory Pension Scheme. Under this, on opening an account, the account holders invest for a long period, after which the account holders get the facility of monthly pension. Similarly, there will also be NPS Vatsalya Yojana.