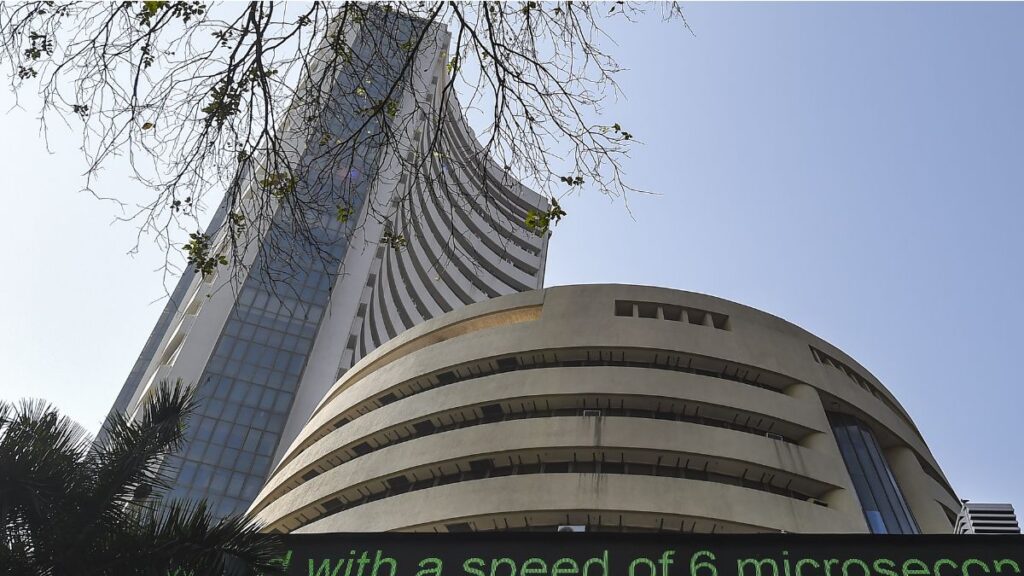

The stock market was opened in red mark on Thursday

Share Market Closing 27st March, 2025: After Wednesday’s drastical fall, there was a minor recovery in the Indian stock market today. On Thursday, the BSE Sensex closed at 77,606.43 points with a gain of 317.93 points (0.41%). While NSE’s Nifty 50 index closed at 23,601.75 points with a gain of 114.90 points (0.49%). Let us tell you that the market started business in red mark with a decline today. But after a while, it came into the green mark when the purchase increased. On Thursday, the Sensex fell by 728.69 points to 77,288.50 points and the Nifty closed at 23,486.85 points with a major loss of 181.80 points.

Tata Motors shares have terrible decline

On Thursday, 20 out of 30 companies of Sensex closed in green mark with gains and the remaining 10 companies closed in red mark with losses. On the other hand, shares of 38 out of 50 of Nifty 50 closed with a rapidly in green mark and the remaining 12 companies closed in red mark with losses. Today, Bajaj Finserv’s shares, one of the Sensex companies, closed down 2.85 percent, while Tata Motors shares closed down 5.38 percent.

NTPC, IndusInd Bank shares also recorded a boom

Apart from these, today NTPC shares 2.78 percent, IndusInd Bank 2.75 percent, Larsen & Toubro 2.10 percent, Bajaj Finance 1.44 percent, UltraTech Cement 1.40 percent, State Bank of India 1.26 percent, Titan 1.20 percent, Adani Ports 0.95 percent, Adani Ports 0.95 percent, HDFC Bank 0.94 percent, HDFC Bank 0.81 percent, Axis Bank 0.68 percent, Reliance Industries shares closed with a gain of 0.66 percent. On the other hand, the shares of Sunpharma today closed 1.41 percent, Hindustan Unilever 1.06 percent, Kotak Mahindra Bank 0.95 percent, Bharti Airtel 0.71 percent, Tata Steel 0.58 percent, Maruti Suzuki 0.53 percent.

Latest business news