hear the news

Expansion

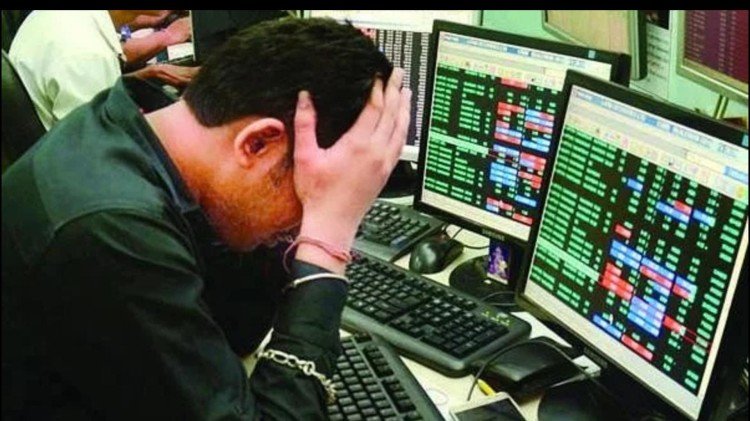

On Thursday, the fourth trading day of the week, the stock market started trading with strong gains, but this momentum could not last long and after a day’s trading, both the indexes finally closed on the red mark. The 30-share Bombay Stock Exchange closed at 51,496 with a loss of 1046 points, while the Nifty of the National Stock Exchange slipped 332 points to end the year’s low at 15,360.

Nifty had slipped to a low of 15,344 on Thursday. The effect of 0.75 percent hike in interest rates by the US Federal Reserve has been seen on the Indian stock market. Due to this fall, investors have lost more than Rs 5 lakh crore. Earlier, the BSE Sensex rose 506 points or 0.96 per cent to 53,048, while the NSE Nifty opened at 15,835 with a gain of 142 points or 0.91 per cent. At the time of opening of the market, there was an increase in about 1437 shares and a fall in 250 shares.

Even before this, the trend of decline in the stock market continued for four consecutive days. After opening with a slight increase in the last trading session on Wednesday, both the indices finally closed with a fall after a day’s trading. The BSE Sensex slipped 152 points to close at 52,541, while the NSE Nifty lost 40 points to close at 15,692.

With this, all 11 sectoral indices of Nifty collapsed. Metal index was the highest 5.24 percent, media stocks fell 3.20 percent in the media. On the other hand, IT and banking stocks also saw a significant fall of two per cent. Among the 30 Sensex stocks, Hindalco and Tata Steel were the biggest losers. While Tata Steel lost 6.04 per cent, Hindalco’s share fell by 6.74 per cent.